Table of Contents

- Pfizer Stock Price Prediction: Will PFE Rise From Ashes For ? - The ...

- Pfizer Stock As A Recession Play (NYSE:PFE) | Seeking Alpha

- Pfizer Remains Whole, but the Option to Split Could Return - The New ...

- PFIZER Stock Price and Chart — NSE:PFIZER — TradingView

- Chart: Pfizer Revenue Boosted by Covid-19 Drugs | Statista

- Modèle économique de Pfizer : comment Pfizer gagne-t-il de l'argent

- Pfizer Stock: Everything You Need to Know Story - Wealthy Nickel

- Pfizer investment is good news for Michigan's life-science sector

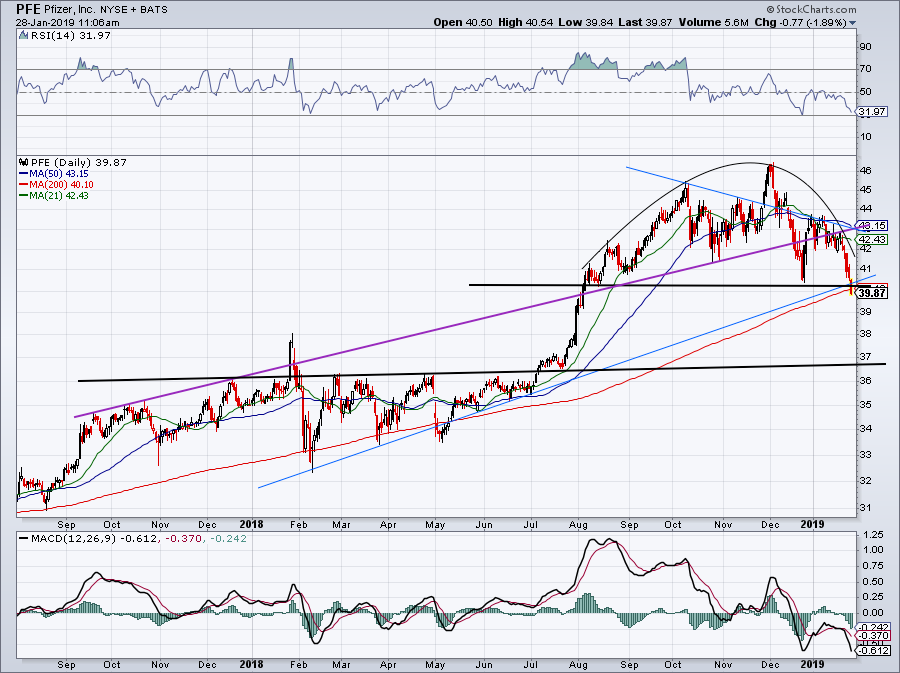

- Pfizer Stock Is at Do-or-Die Spot Ahead of Earnings | InvestorPlace

- Time to Bail on Pfizer Stock? Let’s Look at the Charts | InvestorPlace

Pfizer (PFE) is one of the world's largest and most successful pharmaceutical companies, with a rich history dating back to 1849. As a leading player in the healthcare industry, Pfizer's stock has been a popular choice among investors seeking stable returns and long-term growth. In this article, we'll provide an in-depth analysis of Pfizer's stock price and an overview of the company's performance, helping you make informed investment decisions.

Company Overview

Pfizer is a multinational pharmaceutical corporation headquartered in New York City. The company develops, manufactures, and markets a wide range of medicines and vaccines, including blockbuster drugs such as Lyrica, Prevnar, and Viagra. Pfizer's product portfolio spans various therapeutic areas, including oncology, inflammation and immunology, and rare diseases. With a global presence in over 125 countries, Pfizer employs approximately 88,300 people worldwide.

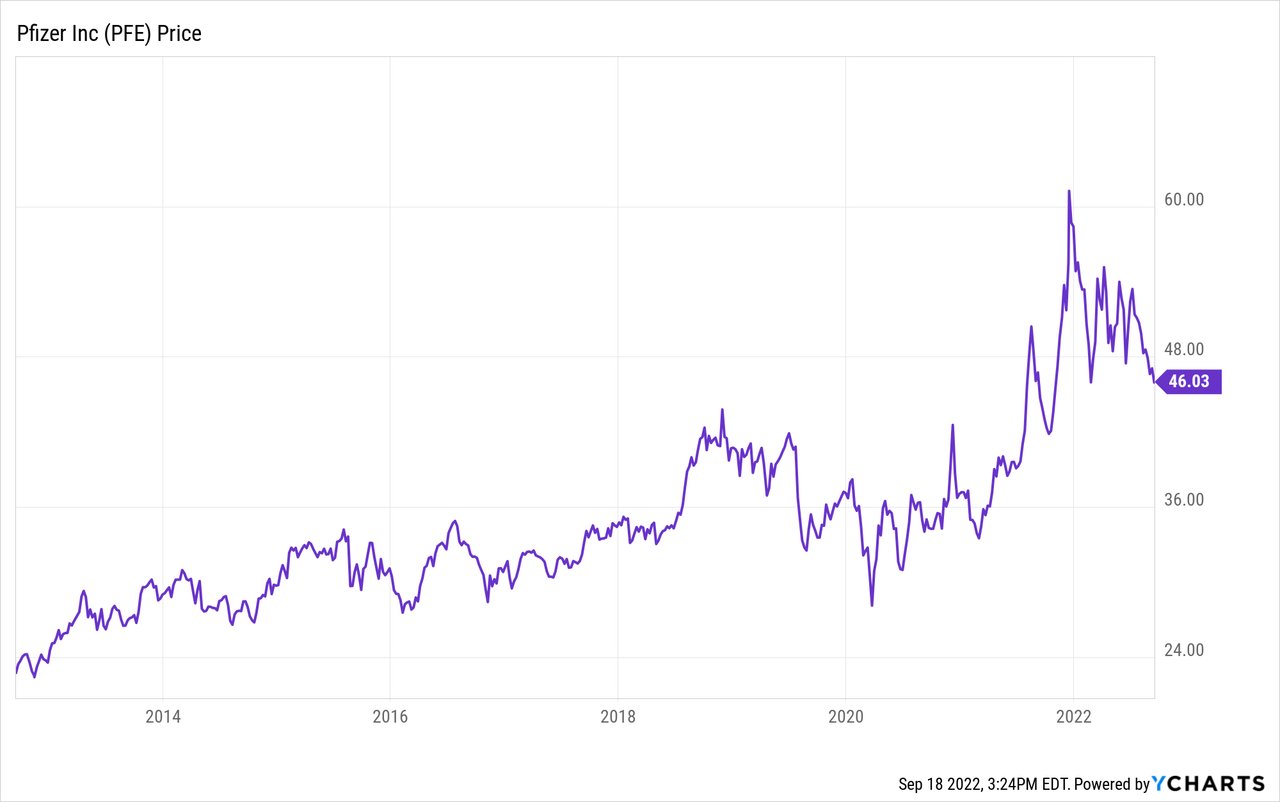

Stock Price Analysis

As of the latest market data, Pfizer's stock price is trading at around $40 per share. Over the past 12 months, the stock has experienced a moderate decline, with a 52-week high of $44.45 and a 52-week low of $33.36. Despite this, Pfizer's stock has consistently outperformed the broader market, with a 5-year average annual return of 10.3% compared to the S&P 500's 8.5%.

Pfizer's stock price is influenced by various factors, including the company's financial performance, industry trends, and regulatory developments. The company's revenue has been driven by the success of its key products, including Lyrica and Prevnar, as well as its growing biosimilars business. However, Pfizer faces intense competition in the pharmaceutical industry, and its stock price may be impacted by patent expirations, generic competition, and changes in healthcare policies.

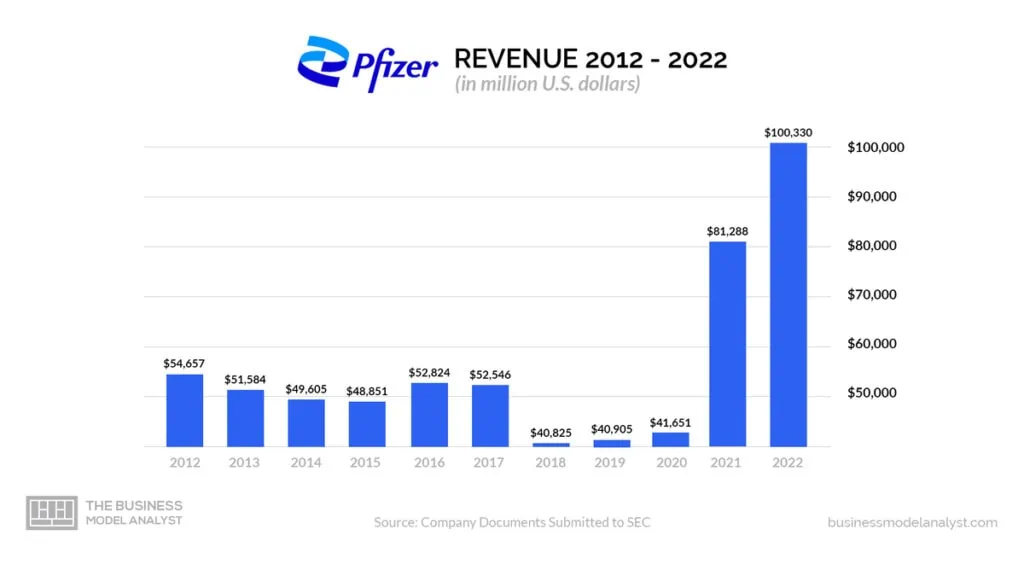

Financial Performance

Pfizer's financial performance has been strong in recent years, with revenues reaching $51.8 billion in 2020. The company's net income was $16.3 billion, representing a margin of 31.5%. Pfizer's cash flow generation has been robust, with operating cash flow of $24.4 billion and free cash flow of $18.5 billion. The company's debt-to-equity ratio stands at 0.83, indicating a moderate level of leverage.

Dividend Yield and Payout Ratio

Pfizer is known for its attractive dividend yield, currently standing at 4.1%. The company has a long history of paying consistent dividends, with a 5-year dividend growth rate of 6.3%. Pfizer's dividend payout ratio is approximately 50%, indicating a sustainable dividend policy and room for future growth.

Pfizer's stock offers a compelling investment opportunity for those seeking stable returns and long-term growth. With a strong financial performance, a diverse product portfolio, and a commitment to innovation, Pfizer is well-positioned to navigate the complexities of the pharmaceutical industry. While the stock price may experience fluctuations, Pfizer's dividend yield and payout ratio provide a relatively stable source of income. As with any investment, it's essential to conduct thorough research and consider your individual financial goals and risk tolerance before making a decision.

By analyzing Pfizer's stock price and overview, investors can gain a deeper understanding of the company's performance and potential for future growth. Whether you're a seasoned investor or just starting to build your portfolio, Pfizer's stock is certainly worth considering.

Note: The data and information provided in this article are for general information purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor or conduct your own research before making investment decisions.